Akbank Türk Anonim Şirketi (Akbank T.A.Ş.) is a private bank established in Adana in 1948. The bank was structured with the aim of providing financing to cotton producers in Adana and its surrounding areas. Today, it is one of Türkiye's largest privately owned banks, offering retail, commercial, corporate, and investment banking services.

History

Akbank Türk Anonim Şirketi was established in Adana, Türkiye on January 30, 1948. The bank's founding purpose was to meet the financing needs of cotton production, especially concentrated in the Çukurova region. Its founders included Hacı Ömer Sabancı, Nuri Has, Nuh Naci Yazgan, Mustafa Özgür, Ahmet Sapmaz, Bekir Sapmaz, and Seyit Tekin.

After its establishment, Akbank carried out its initial activities in Adana, opening its first branch in Istanbul, in the Sirkeci district, on July 14, 1950. With this development, the bank ceased to be a regional institution and began operating on a national scale. In 1954, the general management moved from Adana to Istanbul. This date is considered the year Akbank transferred its central and corporate structure to Istanbul.

In the 1980s, influenced by financial liberalization and technological advancements in the banking sector, Akbank increased its branch network, invested in information technologies, and expanded its range of banking products.

In 1990, the bank went public, and in the same year, its shares began trading on Borsa İstanbul (then known as İMKB). In 1998, the American Depositary Receipt (ADR) program was launched to facilitate access for foreign investors, and the bank's shares also began trading on international markets.

In the 2000s, the bank developed digital banking services, expanding its product offerings through internet and mobile applications. Concurrently, it initiated various programs in areas such as corporate social responsibility, sustainability, and financial inclusion.

In the 2020s, Akbank diversified its operations in payment systems, investment advisory, electronic money services, and international banking through its investments in financial technologies and its subsidiaries.

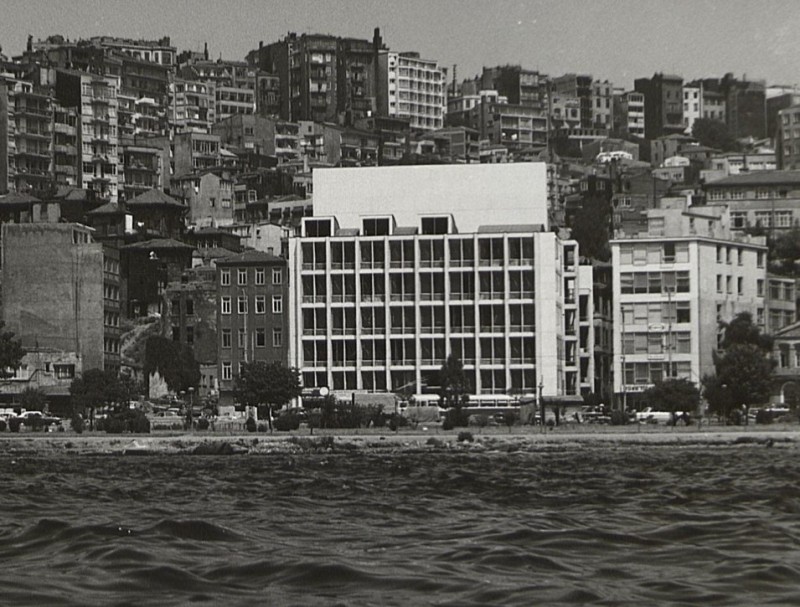

Akbank Old General Directorate Building (İBB)

Corporate Structure and Partnership

Akbank has the status of a joint-stock company. It is a publicly traded company, and its shares are listed on Borsa İstanbul. The bank's capital structure is as follows:

- %42 – Sabancı Holding, Affiliated Institutions and individuals

- %58– Publicly Held Portion

Areas of Operation

Akbank offers various financial services to individual and corporate clients in Türkiye and abroad. Its areas of operation include:

- Retail banking

- SME banking

- Commercial and corporate banking

- Investment banking

- Private banking

- Treasury operations

- Payment systems

- International banking

The services offered by the bank are conducted through physical branches as well as digital channels, mobile applications, and internet banking.

Subsidiaries and Affiliates

Among the financial subsidiaries and affiliated companies controlled by Akbank are the following:

- Ak Yatırım Menkul Değerler A.Ş.

- Ak Portföy Yönetimi A.Ş.

- AKLease Finansal Kiralama A.Ş.

- AkÖde Elektronik Para ve Ödeme Hizmetleri A.Ş.

- Akbank AG (Germany)

- Akbank Ventures A.Ş.

General Directorate and Organization

Akbank's general directorate building is located within Sabancı Center in the Levent district of Istanbul.